About Us

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Get a QuoteContact Us

Expert guidance for denied, declined, delayed insurance claims.

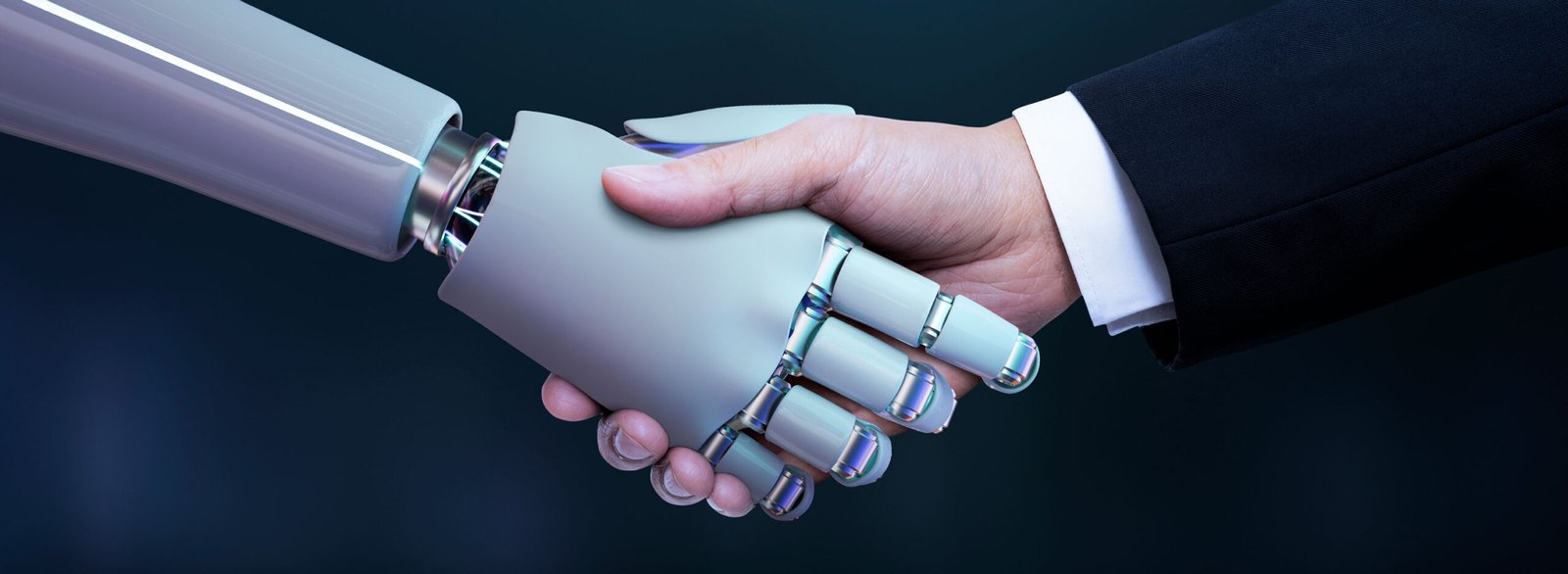

India’s most advanced AI based Insurance Reclaim Platform

At Claimskart, we streamline your insurance reclaim journey—from policy analysis, claim processing, and filing, to final settlement before the relevant authorities. Our mission is to help you reclaim what is rightfully yours. Claim what’s yours-fast, fair and flawless.

Best Awards Winning Company

About Insurance

We Provide Effective Insurance Services and Solutions

Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam nisi ut aliquid commodie

consequatur buy business insurance the set experience

Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam nisi ut aliquid commodie

consequatur buy business insurance the set experience Register Customer

Years Of Experience

Awards Winning

About Claimskart

We are your trusted insurance reclaim partners—an expert team of advisers, agents, and advocates, reinforced by AI and supported by seasoned professionals in medicine, insurance, and law (AI-MIL). We specialize in helping policyholders challenge rejected, denied, or repudiated claims across all types of insurance, including health, life, motor, travel, and business coverage. Our approach is meticulous: we analyze your policy, identify the reasons for claim rejection, navigate complex legal and regulatory frameworks, and build a strong, evidence-backed case on your behalf. With our guidance and representation before the relevant authorities, we ensure that you receive the claims you rightfully deserve.

- A complete POST INSURANCE SALES – SERVICE AND SOLUTIONS (PIS-SS)

- Backed by Insurance Reclaim AI – Agent verified by Industry experts- Medical, Insurance and Lawyers (AI-MIL)

Why ClaimsKart

The Right Ally When Insurance Says “No”

Expert-Backed Process: Your case is handled by insurance and legal professionals

AI-Driven Document Review: Faster and more accurate claim assessments

Transparent Tracking: Real-time updates through your personal dashboard.

Proven Success Rate: We've helped hundreds reclaim their rightful claims.

WHY CLAIMSKART?

We are your Advisor - Agent - Advocate

- Al-MIL driven document review – Faster and move industry experts accurate reclaim assessments.

- Reduced risk of claim rejection – Rejections often arise from incorrect policy interpretations. Our platform uses advanced validation tools to cross-check claim data and flag inconsistencies before submission, ensuring fewer rejections and a higher success rate for your reclaims.

- Transparency and Time tracking – We monitor every step of the claims process, track required actions, and eliminate uncertainties, building greater trust and confidence for policyholders.

- Fraud detection & compliance – We leverage AI and a rule-based engine to detect anomalies and fraudulent claims, helping insurers maintain robust compliance with regulatory frameworks.

- Cost Efficiency and productivity – Our automated, AI-MIL analytical tools enable faster handling of documentation, allowing more time to focus on strategic decision-making and legal follow-ups.

- Dedicated Reclaim Platform – Our AI-MIL-driven platform manages all policy-related documentation, including photos, bills, and correspondences, allowing seamless integration with the relevant authorities for a smooth, end-to-end reclaim journey. We empower policyholders to efficiently and transparently reclaim denied, delayed, or unpaid claims, bridging the gap with automation, document intelligence, and expert intervention from industry professionals.

OUR SERVICES

We Specialize In

OUR PROCESS

Simple. Seamless. Strategic.

Upload Documents

Share your rejected claim documents through our secure platform

Expert Validation

Team reviews your case, identifies grounds for appeal & prepares file.

Claim Representation

Represent you to insurer, regulatory bodies or ombudsman, if needed

Track Progress

Track progress in Real-time dashboard — anytime, anywhere.

Claim Settled

Claim settled. Money credited:— fast, secure, and stress-free.

Exclusive Team

Meet Our Professional Team Members

Find Your Insurance Agent! Say Hello

Insurance Agent

FAQs

Learn About Our Insurance Solution

A denial means your insurer has rejected your claim due to reasons like missing documents, policy exclusions, or errors in the application.

Yes, in most cases you can appeal the decision by submitting additional documents or clarifications within the timeline mentioned by your insurer.

Claims from health insurance, life insurance (death benefit), motor insurance, and personal accident policies can often be appealed.

Non-disclosure of pre-existing conditions

Policy lapses or non-renewal

Incomplete documents

Treatment not covered under the policy

Delay in claim intimation

Yes, ClaimsKart your AI-powered platform can analyze claim data, suggest corrections, and assist in drafting appeals more efficiently and accurately.

TESTIMONIALS

What Clients Say...

My health insurance claim was rejected due to a 'technicality'. ClaimsKart fought it and won me the full settlement. Highly professional!

Anita M.

Bangalore

I had given up on my car insurance claim. These guys are the real deal. Quick, transparent, and relentless

Ravi S.

Mysore

The ClaimsKart team guided me like a friend through the entire process. I recommend them to everyone dealing with unfair rejections

Preeti K

Pune

CONTACT US

Need Expert Advice. Talk to Us

News & Blog

Read Every Insurance News & Blog

Reclaim Your Denied Insurance Claims.

We offer expert guidance and transparent support to help you successfully appeal Denied Policies. Our team of Industry Specialists and Legal Experts are here to assist you every step of the way.

© Claimskart 2025. All rights reserved